Monday, May 31, 2021

Accelerating AI in Finance With Milvus, an Open-Source Vector Database

Banks and other financial institutions have long been early adopters of open-source software for big data processing and analytics. In 2010, Morgan Stanley began using the open-source Apache Hadoop framework as part of a small experiment. The company was struggling to successfully scale traditional databases to the massive volumes of data its scientists wanted to leverage, so it decided to explore alternative solutions. Hadoop is now a staple at Morgan Stanley, helping with everything from managing CRM data to portfolio analysis. Other open-source relational database software such as MySQL, MongoDB, and PostgreSQL have been indispensable tools for making sense of big data in the finance industry.

Technology is what gives the financial services industry a competitive edge, and artificial intelligence (AI) is rapidly becoming the standard approach to extracting valuable insights from big data and analyzing activity in real-time across the banking, asset management, and insurance sectors. By using AI algorithms to convert unstructured data such as images, audio, or video to vectors, a machine-readable numeric data format, it is possible to run similarity searches on massive million, billion, or even trillion vector datasets. Vector data is stored in high-dimensional space, and similar vectors are found using similarity search, which requires a dedicated infrastructure called a vector database.

from DZone.com Feed https://ift.tt/3vgOILr

AWS App Deployment Basics: VPC and PostgreSQL Setup

Introduction

In this series about deploying applications in AWS, I will discuss different methods and steps required to run different applications in AWS. We will be covering different moving parts in AWS as needed to run typical applications.

This series will be arranged in different parts to discuss different services, topics, and/or technologies needed for application deployment and execution.

from DZone.com Feed https://ift.tt/3wGXaDG

How A Java Program Is Executed? – Heap, Threads, Stack, GC [Video]

What happens behind the scene when a Java program is executed? In which regions objects are created? When objects become eligible for garbage collection? Where are threads stored? What is the difference between Stack and Heap? Watch this video to know more.

from DZone.com Feed https://ift.tt/3ySezeD

Jeff Bezos’ API Mandate: What the 5 Rules Mean and Do

In 2002, Jeff Bezos issued what is now known as the API mandate: The new direction at Amazon would be that all capabilities would have to be designed and exposed as APIs. This is an early version of what we today call API First. Most importantly, the mandate had a laser focus on the fact that APIs need the network effect to produce the most value, and thus it simply said that APIs are not optional anymore.

from DZone.com Feed https://ift.tt/3i6W4gt

The Frustrated Scrum Master — When All the Effort Leads Nowhere

TL;DR: The Frustrated Scrum Master — When All the Effort Leads Nowhere

There are plenty of failure possibilities with Scrum. Given that Scrum is a framework with a reasonable yet short "manual," this effect should not surprise anyone. One failure symptom of a botched agile transformation is the frustrated Scrum Master.

Join me and explore the consequences of a Scrum Master who has thrown in the towel in 92 seconds.

from DZone.com Feed https://ift.tt/2RRHoaE

Big Data + MySQL = Mission InnoPossible?

Preface

If you’re a MySQL DBA or a developer that deals with MySQL instances daily, it will probably not come as a surprise if you hear that you should not run big data sets on MySQL. Ask almost any MySQL DBA, and you will hear something like:

- "MySQL is not a fit!"

- "Have you looked into NoSQL?"

- "Use MongoDB."

Some of these responses indeed have merit — for example, NoSQL-based database management systems such as MongoDB can certainly be useful when dealing with big data sets. However, contrary to popular belief, MySQL shouldn’t be so quickly ruled out — in some scenarios, MySQL (or MariaDB) might prove to be even better options for big data than their NoSQL counterparts! In this article, we will explore the things you should consider when answering the question: “Is MySQL a good option for my big data project?”

from DZone.com Feed https://ift.tt/3c7CZai

Singapore-based D2C dental brand Zenyum raises $40M Series B from L Catterton, Sequoia India and other investors

Zenyum, a startup that wants to make cosmetic dentistry more affordable, announced today it has raised a $40 million Series B. This includes $25 million from L Catterton, a private equity firm focused on consumer brands. The round’s other participants were Sequoia Capital India (Zenyum is an alum of its Surge accelerator program), RTP Global, Partech, TNB Aura, Seeds Capital and FEBE Ventures. L Catteron Asia’s head of growth investments, Anjana Sasidharan, will join Zenyum’s board.

This brings Zenyum’s total raised so far to $56 million, including a $13.6 million Series A announced in November 2019. In a press statement, Sasidharan said, “Zenyum’s differentiated business model gives it a strong competitive advantage, and we are excited to partner with the founder management team to help them realize their growth ambitions.” Other dental-related investments in L Catteron’s portfolio include Ideal Image, ClearChoice, dentalcorp, OdontoCompany, Espaçolaser and 98point6.

Founded in 2018, the company’s products now include ZenyumSonic electric toothbrushes; Zenyum Clear, or transparent 3D-printed aligners; and ZenyumClear Plus for more complex teeth realignment cases.

Founder and chief executive officer Julian Artopé told TechCrunch that ZenyumClear aligners can be up to 70% cheaper than other braces, including traditional metal braces, lingual braces and other clear aligners like Invisalign, depending on the condition of a patients’ teeth and what they want to achieve. Zenyum Clear costs $2,400 SGD (about $1,816 USD), while ZenyumClear Plus ranges from $3,300 to $3,900 SGD (about $2,497 to $2,951 USD).

The company is able to reduce the cost of its invisible braces by combining a network of dental partners with a technology stack that allows providers to monitor patients’ progress while reducing the number of clinic visits they need to make.

First, potential customers send a photo of their teeth to Zenyum to determine if ZenyumClear or ZenyumClear Plus will work for them. If so, they have an in-person consultation with a dentists, including an X-ray and 3D scan. This costs between $120 to $170 SGD, which is paid to the clinic. After their invisible braces are ready, the patient returns to the dentist for a fitting. Then dentists can monitor the progress of their patient’s teeth through Zenyum’s app, only asking them to make another in-person visit if necessary.

ZenyumClear is currently available in Singapore, Malaysia, Indonesia, Hong Kong, Macau, Vietnam, Thailand and Taiwan, with more markets planned.

Sequoia India principal Pieter Kemps told TechCrunch, “There are 300M customers in Zenyum’s core markets—Southeast Asia, Hong Kong, Taiwan—who have increased disposable income for beauty. We believe spend on invisible braces will grow significantly from the current penetration, but what it requires is strong execution on a complex product to become the preferred choice for consumers. That is where Zenyum shines: excellent execution, leading to new products, best-in-class NPS, fast growth, and strong economics. This Series B is a testament to that, and of the belief in the large opportunity down the road.”

from TechCrunch https://ift.tt/3vE5pQN

Top 5 eCommerce Trends For 2022

Online shopping is growing at a fast pace and is expected to reach $1 trillion by 2022. But, eCommerce shopping won’t be the same as it is now. There are several eCommerce trends that will shape the future of the eCommerce industry.

Advancement in voice search technologies, adoption of VR, acceptance of bitcoins, and usage of chatbots for personalized product recommendations are some of the trends that will improve the overall shopping experience of the users.

from DZone.com Feed https://ift.tt/3p9csys

Basics of FHIR

What is FHIR?

To be short and precise, FHIR (Fast Healthcare Interoperability Resources) is a standard for exchanging healthcare information electronically.

FHIR has been developed by HL7 for using it as a stand-alone exchange standard or to be used as with other standards such as HL7 v2, CDA and CCDA

from DZone.com Feed https://ift.tt/3fXjPoP

Working With Neo4j Graph Database

Traditionally, a majority of our applications relied on relational database systems (RDBMS) for their data storage needs. But RDBMS systems are not very efficient at handling high volumes of connected data. A graph database is purpose-built to store this category of connected data.

In this article, we will explore the basic concepts of a graph database and then look at some examples of graph data modeling and querying by using the Neo4j graph database.

from DZone.com Feed https://ift.tt/2Tv4RPg

What Is Technical Debt?

The term technical debt was coined by Ward Cunningham in 1992. To understand technical debt, let's compare it with financial debt.

Financial debt is an arrangement that gives the borrowing party permission to borrow money under the condition that it is to be paid back at a later date, usually with interest. Financial debt is generally needed due to overspending, lack of financial knowledge, poorly managed budget, etc. to name a few. You might also raise a financial debt to invest in your capital-intensive business, education, etc. which would bring returns in the future. Financial debt is not always a bad thing as long as you're aware of the consequences and always keep it under control.

from DZone.com Feed https://ift.tt/3wDNMRs

Video e-learning platform for MENA, Almentor, closes $6.5M Series B led by Partech

There are more than 400 million Arabic speakers globally and that number isn’t slowing down anytime soon. Arabic, to most people, is a tough language even to those who speak it. According to Duolingo, someone fluent in Egyptian Arabic might not fully understand Yemeni Arabic speakers because of the vast difference in dialect.

While individuals can easily navigate dialects, it can be relatively hard for them to find tailored Arabic content essential for everyday life.

Dr Ihab Fikry and Ibrahim Kamel founded Almentor.net in 2016 as an online video learning platform to compensate for this lack of online learning content for Arabic speakers. In collaboration with hundreds of leaders, educators, and experts, the platform offers courses and talks in various fields like health, humanities, technology, entrepreneurship, business management, lifestyle, drama, sports, corporate communication, and digital media.

In 2016, Almentor closed a $3.5 million seed round and two years ago raised $4.5 million Series A led by Egypt’s Sawari Ventures. With this Series B investment, the Dubai-based edtech company has raised $14.5 million in total. San Francisco and Paris-based VC firm Partech led the financing round with participation from Sawari Ventures, fellow Series A investor Egypt Ventures, and Sango Capital.

Almentor provides Arab learners with the necessary skills crucially needed to advance their professional careers and personal lives. The platform claims to have the biggest continuous learning library in the region and one of the biggest worldwide. With offices in Dubai, Cairo, and Saudi Arabia, its video content is developed in-house and made in Arabic and English.

“The vision and reason behind starting Almentor is we understand that in our region of more than 100 million people, of which 90% cannot properly learn with any other language other than Arabic,” Fikry said to TechCrunch. “So we wanted to have a cutting-edge state of the art platform that will change people’s ideology and help them be objective, and focus based on topics that can be taught as prodigious learning.”

For first-time products like Almentor, it can be hard to get both investors and customers on board. According to CEO Fikry, the first challenge was to convince the investment community in the MENA region that Almentor was creating a new industry in video e-learning that “had lots of potential to power tools in the region.”

Almentor’s business is an intersection of education, media, and technology. Its offerings are dissected into three: the flagship B2C product, a white-label B2B model for blue-chip companies, and the last, which Fikry calls the ‘special project’ for governmental bodies.

For its B2C product, Almentor sells courses to users for $20-$30 of which they get to keep for a lifetime. Fikry says that in June, the company is planning to introduce a subscription-based model where users can have unlimited access to all of its 12,000 video content for a fee to its more than 1 million registered users.

The B2B model is where Almentor opens its library to companies to customize their content for employees. These videos are mainly tutorials or training needed to thrive at work, and since 2016, Almentor has executed 78 deals with partner companies.

The special project’s model highlights Almentor’s work with the government. One time, the company had a partnership with the Egyptian government to upskill the country’s movie industry. It has completed 11 more similar special projects since launching five years ago.

Across all three models, Fikry says Almentor has successfully delivered more than 2 million learning experiences. With this investment, the company wants to improve content production and quality and educate people in the MENA region on why they need the product.

“We are now leading the continuous video learning industry in the Arab region, and we have a responsibility that goes beyond our ambitions for Almentor. Our responsibility now is to work unceasingly to improve the industry as a whole in the Arab region, and this can only be achieved through gaining the confidence of the Arab learners in the value, professionalism and impartiality of the content provided by the platform and working in line with the global learning trends.”

Speaking on the investment for Partech, general partner Cyril Collon said: “Since our first interaction, we have been very impressed by Ihab and Ibrahim, two fantastic mission-driven entrepreneurs who have been executing on a bold vision since 2016, and who built the leading Arabic self-learning go-to content provider in the Middle East and Africa. We are looking forward to supporting the company in its next phase of growth to serve the 430 million Arabic-speaking population and expand access to on-demand cutting-edge personal learning & developments options.”

from TechCrunch https://ift.tt/3c5BERe

Sunday, May 30, 2021

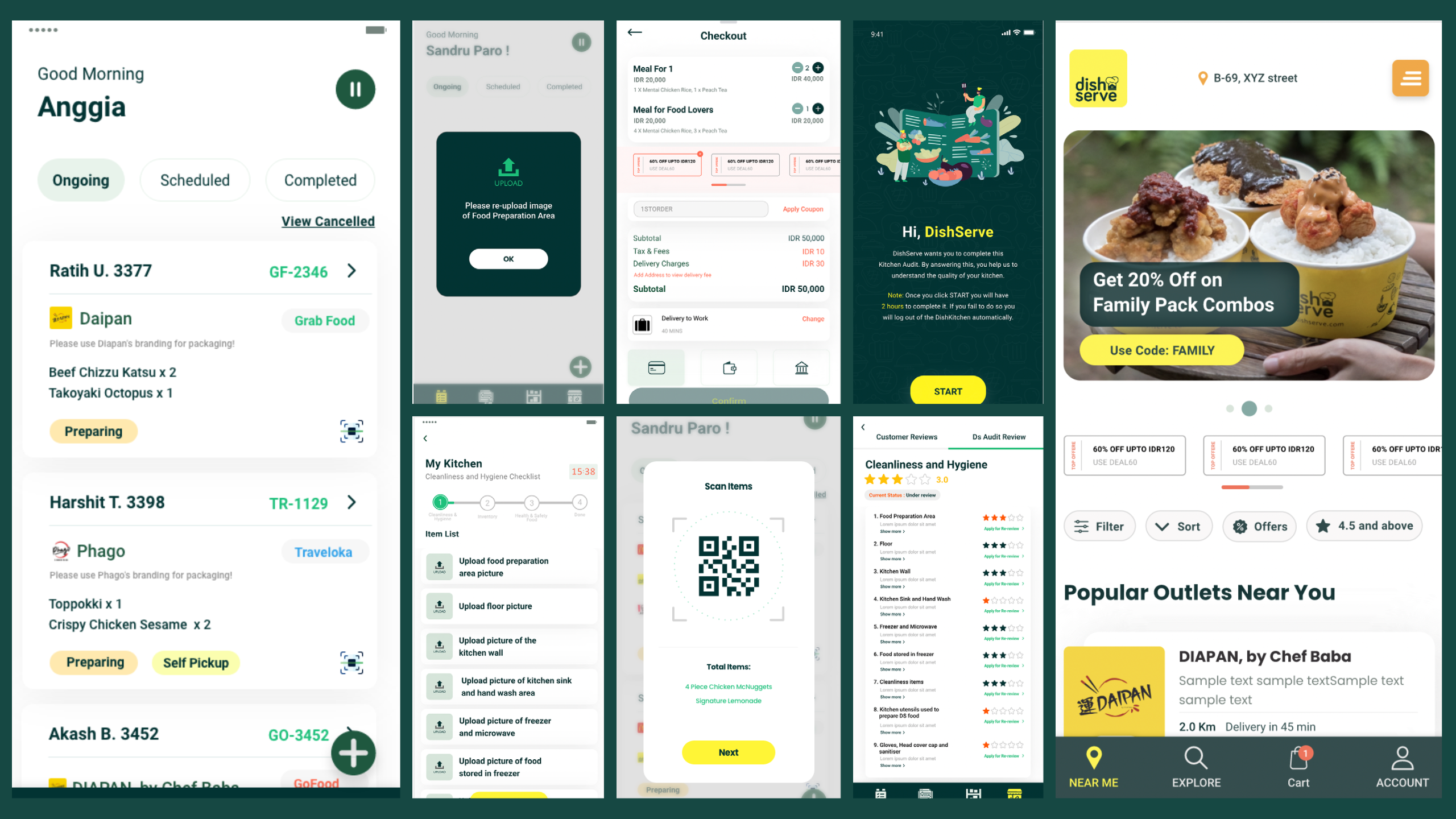

By working with home entrepreneurs, Jakarta-based DishServe is creating an even more asset-light version of cloud kitchens

Cloud kitchens are already meant to reduce the burden of infrastructure on food and beverage brands by providing them with centralized facilities to prepare meals for delivery. This means the responsibility falls on cloud kitchen operators to make sure they have enough locations to meet demand from F&B clients, while ensuring fast deliveries to end customers.

Indonesian network DishServe has figured out a way to make running cloud kitchen networks even more asset-light. Launched by budget hotel startup RedDoorz’s former chief operating officer, DishServe partners with home kitchens instead of renting or buying its own facilities. It currently works with almost 100 home kitchens in Jakarta, and focuses on small- to medium-sized F&B brands, serving as their last-mile delivery network. Launched in fall 2020, DishServe has raised an undisclosed amount of pre-seed funding from Insignia Ventures Partners.

DishServe was founded in September 2020 by Rishabh Singhi. After leaving RedDoorz at the end of 2019, Singhi moved to New York, with plans to launch a new hospitality startup that could quickly convert any commercial space into members’ clubs like Soho House. The nascent company had already created sample pre-fabricated rooms and was about to start leasing property when the COVID-19 lockdown hit New York City in March 2020. Singhi said he went on a “soul searching spree” for a couple of months, deciding what to do and if he should return to Southeast Asia.

He realized that since many restaurants had to switch to online orders and delivery to survive the pandemic, this could potentially be an equalizer for small F&B brands that compete with larger players, like McDonald’s. But lockdowns meant that a lot of people had to pick from a limited range of restaurants close to where they lived. At the same time, Singhi saw that there were a lot of people who wanted to make more money, but couldn’t work outside of their homes, like stay-at-home moms.

DishServe was created to connect all three sides: F&B brands that want to expand without spending a lot of money, home entrepreneurs and diners hungry for more food options. Its other founders include Stefanie Irma, an early RedDoorz employee who served as its country head for the Philippines; serial entrepreneur Vinav Bhanawat; and Fathhi Mohamed, who also co-founded Sri Lankan on-demand taxi service PickMe.

The company works with F&B brands that typically have between just one to 15 retail locations, and want to increase their deliveries without opening new outlets. DishServe’s clients also include cloud kitchen companies who use its home kitchen network for last-mile distribution to expand their delivery coverage and catering services.

“The brands don’t to have to incur any upfront costs, and it’s a cheaper way to distribute as well because they don’t have to pay for electricity, plumbing and other things like that,” said Singhi. “And for agents, it gives them a chance to earn money from their homes.”

How it works

Before adding a home kitchen to its network, DishServe screens applicants by asking them to send in a series of photos, then doing an in-person check. If a kitchen is accepted, DishServe upgrades it so it has the same equipment and functionality as the other home kitchens in its network. The company covers the cost of the conversion process, which usually takes about three hours and costs $500 USD, and maintains ownership of the equipment, taking it back if a kitchen decided to stop working with DishServe. Singhi said DishServe is usually able to recover the cost of a conversion four months after a kitchen begins operating.

Home kitchens start out by serving DishServe’s own white-label brand as a trial run before it opens to other brands. Each can serve up to three additional brands at a time.

One important thing to note is that DishServe’s home kitchens, which are usually run by one person, don’t actually cook any food. Ingredients are provided by F&B brands, and home kitchen operators follow a standard set of procedures to heat, assemble and package meals for pick-up and delivery.

DishServe makes sure standard operating procedures and hygiene standards are being maintained through frequent online audits. Agents, or kitchen operators, regularly submit photos and videos of kitchens based on a checklist (i.e. food preparation area, floors, walls, hand-washing area and the inside of their freezers). Singhi said about 90% of its agents are women between the ages of 30 to 55, with an average household income of $1,000. By working with DishServe, they typically make an additional $600 a month once their kitchen is operating at full capacity with four brands. DishServe monetizes through a revenue-sharing model, charging F&B brands and splitting that with its agents.

After joining DishServe, F&B brands pick what home kitchens they want to work with, and then distribute ingredients to kitchens, using DishServe’s real-time dashboard to monitor stock. Some ingredients have a shelf life of up to six months, while perishables, like produce, dairy and eggs, are delivered daily. DishServe’s “starter pack” for onboarding new brands lets them pick pick five kitchens, but Singhi said most brands usually begin with between 10 to 20 kitchens so they can deliver to more spots in Jakarta and save money by preparing meals in bulk.

DishServe plans to focus on growing its network in Jakarta until at least the end of this year, before expanding into other cities. “One thing we are trying to change about the F&B industry is that instead of highly-concentrated, centralized food business, like what exists today, we are decentralizing it by enabling micro-entrepreneurs to act as a distribution network,” Singhi said.

from TechCrunch https://ift.tt/3i3xGfI

Europe’s cookie consent reckoning is coming

Cookie pop-ups getting you down? Complaints that the web is ‘unusable’ in Europe because of frustrating and confusing ‘data choices’ notifications that get in the way of what you’re trying to do online certainly aren’t hard to find.

What is hard to find is the ‘reject all’ button that lets you opt out of non-essential cookies which power unpopular stuff like creepy ads. Yet the law says there should be an opt-out clearly offered. So people who complain that EU ‘regulatory bureaucracy’ is the problem are taking aim at the wrong target.

EU law on cookie consent is clear: Web users should be offered a simple, free choice — to accept or reject.

The problem is that most websites simply aren’t compliant. They choose to make a mockery of the law by offering a skewed choice: Typically a super simple opt-in (to hand them all your data) vs a highly confusing, frustrating, tedious opt-out (and sometimes even no reject option at all).

Make no mistake: This is ignoring the law by design. Sites are choosing to try to wear people down so they can keep grabbing their data by only offering the most cynically asymmetrical ‘choice’ possible.

However since that’s not how cookie consent is supposed to work under EU law sites that are doing this are opening themselves to large fines under the General Data Protection Regulation (GDPR) and/or ePrivacy Directive for flouting the rules.

See, for example, these two whopping fines handed to Google and Amazon in France at the back end of last year for dropping tracking cookies without consent…

While those fines were certainly head-turning, we haven’t generally seen much EU enforcement on cookie consent — yet.

This is because data protection agencies have mostly taken a softly-softly approach to bringing sites into compliance. But there are signs enforcement is going to get a lot tougher. For one thing, DPAs have published detailed guidance on what proper cookie compliance looks like — so there are zero excuses for getting it wrong.

Some agencies had also been offering compliance grace periods to allow companies time to make the necessary changes to their cookie consent flows. But it’s now a full three years since the EU’s flagship data protection regime (GDPR) came into application. So, again, there’s no valid excuse to still have a horribly cynical cookie banner. It just means a site is trying its luck by breaking the law.

There is another reason to expect cookie consent enforcement to dial up soon, too: European privacy group noyb is today kicking off a major campaign to clean up the trashfire of non-compliance — with a plan to file up to 10,000 complaints against offenders over the course of this year. And as part of this action it’s offering freebie guidance for offenders to come into compliance.

Today it’s announcing the first batch of 560 complaints already filed against sites, large and small, located all over the EU (33 countries are covered). noyb said the complaints target companies that range from large players like Google and Twitter to local pages “that have relevant visitor numbers”.

“A whole industry of consultants and designers develop crazy click labyrinths to ensure imaginary consent rates. Frustrating people into clicking ‘okay’ is a clear violation of the GDPR’s principles. Under the law, companies must facilitate users to express their choice and design systems fairly. Companies openly admit that only 3% of all users actually want to accept cookies, but more than 90% can be nudged into clicking the ‘agree’ button,” said noyb chair and long-time EU privacy campaigner, Max Schrems, in a statement.

“Instead of giving a simple yes or no option, companies use every trick in the book to manipulate users. We have identified more than fifteen common abuses. The most common issue is that there is simply no ‘reject’ button on the initial page,” he added. “We focus on popular pages in Europe. We estimate that this project can easily reach 10,000 complaints. As we are funded by donations, we provide companies a free and easy settlement option — contrary to law firms. We hope most complaints will quickly be settled and we can soon see banners become more and more privacy friendly.”

To scale its action, noyb developed a tool which automatically parses cookie consent flows to identify compliance problems (such as no opt out being offered at the top layer; or confusing button coloring; or bogus ‘legitimate interest’ opt-ins, to name a few of the many chronicled offences); and automatically create a draft report which can be emailed to the offender after it’s been reviewed by a member of the not-for-profit’s legal staff.

It’s an innovative, scalable approach to tackling systematically cynical cookie manipulation in a way that could really move the needle and clean up the trashfire of horrible cookie pop-ups.

noyb is even giving offenders a warning first — and a full month to clean up their ways — before it will file an official complaint with their relevant DPA (which could lead to an eye-watering fine).

Its first batch of complaints are focused on the OneTrust consent management platform (CMP), one of the most popular template tools used in the region — and which European privacy researchers have previously shown (cynically) provides its client base with ample options to set non-compliant choices like pre-checked boxes… Talk about taking the biscuit.

A noyb spokeswoman said it’s started with OneTrust because its tool is popular but confirmed the group will expand the action to cover other CMPs in the future.

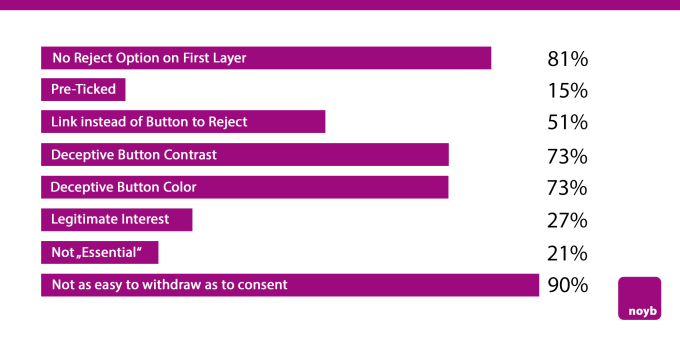

The first batch of noyb’s cookie consent complaints reveal the rotten depth of dark patterns being deployed — with 81% of the 500+ pages not offering a reject option on the initial page (meaning users have to dig into sub-menus to try to find it); and 73% using “deceptive colors and contrasts” to try to trick users into clicking the ‘accept’ option.

noyb’s assessment of this batch also found that a full 90% did not provide a way to easily withdraw consent as the law requires.

Cookie compliance problems found in the first batch of sites facing complaints (Image credit: noyb)

It’s a snapshot of truly massive enforcement failure. But dodgy cookie consents are now operating on borrowed time.

Asked if it was able to work out how prevalent cookie abuse might be across the EU based on the sites it crawled, noyb’s spokeswoman said it was difficult to determine, owing to technical difficulties encountered through its process, but she said an initial intake of 5,000 websites was whittled down to 3,600 sites to focus on. And of those it was able to determine that 3,300 violated the GDPR.

That still left 300 — as either having technical issues or no violations — but, again, the vast majority (90%) were found to have violations. And with so much rule-breaking going on it really does require a systematic approach to fixing the ‘bogus consent’ problem — so noyb’s use of automation tech is very fitting.

More innovation is also on the way from the not-for-profit — which told us it’s working on an automated system that will allow Europeans to “signal their privacy choices in the background, without annoying cookie banners”.

At the time of writing it couldn’t provide us with more details on how that will work (presumably it will be some kind of browser plug-in) but said it will be publishing more details “in the next weeks” — so hopefully we’ll learn more soon.

A browser plug-in that can automatically detect and select the ‘reject all’ button (even if only from a subset of the most prevalent CMPs) sounds like it could revive the ‘do not track’ dream. At the very least, it would be a powerful weapon to fight back against the scourge of dark patterns in cookie banners and kick non-compliant cookies to digital dust.

from TechCrunch https://ift.tt/2SIjXAi

Africa has another unicorn as Chipper Cash raises $100M Series C led by SVB Capital

Fintech in Africa is a goldmine. Investors are betting big on startups offering a plethora of services from payments and lending to neobanks, remittances and cross-border transfers, and rightfully so. Each of these services solves unique sets of challenges. For cross-border payments, it’s the outrageous rates and regulatory hassles involved with completing transactions from one African country to another.

Chipper Cash, a three-year-old startup that facilitates cross-border payment across Africa, has closed a $100 million Series C round to introduce more products and grow its team.

It hasn’t been too long ago since Chipper Cash was last in the news. In November 2020, the African cross-border fintech startup raised $30 million Series B led by Ribbit Capital and Jeff Bezos fund Bezos Expeditions. This was after closing a $13.8 million Series A round from Deciens Capital and other investors in June 2020. Hence, Chipper Cash has gone through three rounds totalling $143.8 million in a year. However, when the $8.4 million raised in two seed rounds back in 2019 is included, this number increases to $152.2 million.

SVB Capital, the investment arm of U.S. high-tech commercial bank Silicon Valley Bank led this Series C round. Others who participated in this round include existing investors — Deciens Capital, Ribbit Capital, Bezos Expeditions, One Way Ventures, 500 Startups, Tribe Capital, and Brue2 Ventures.

Chipper Cash was launched in 2018 by Ham Serunjogi and Maijid Moujaled. The pair met in Iowa after coming to the U.S. for studies. Following their stints at big names like Facebook, Flickr and Yahoo!, the founders decided to work on their own startup.

Last year, the company which offers mobile-based, no fee, P2P payment services, was present in seven countries: Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya. Now, it has expanded to a new territory outside Africa. “We’ve expanded to the U.K., it’s the first market we’ve expanded to outside Africa,” CEO Serunjogi said to TechCrunch.

In addition and as a sign of growth, the company which boasts more than 200 employees plans to increase its workforce by hiring 100 staff throughout the year. The number of users on Chipper Cash has increased to 4 million, up 33% from last year. And while the company averaged 80,000 transactions daily in November 2020 and processed $100 million in payments value in June 2020, it is unclear what those figures are now as Serunjogi declined to comment on them, including its revenues.

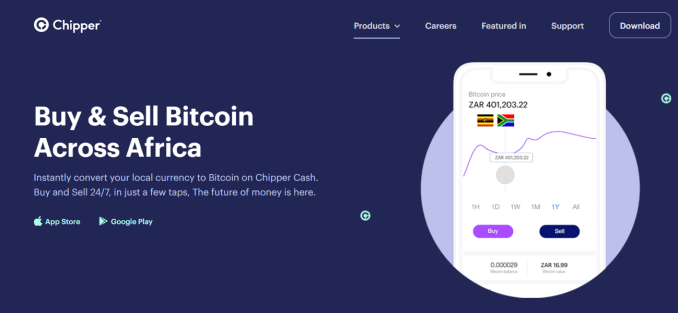

When we reported its Series B last year, Chipper Cash wanted to offer more business payment solutions, cryptocurrency trading options, and investment services. So what has been the progress since then? “We’ve launched cards products in Nigeria and we’ve also launched our crypto product. We’re also launching our US stocks product in Uganda, Nigeria and a few other countries soon,” Serunjogi answered.

Crypto is widely adopted in Africa. African users are responsible for a sizeable chunk of transactions that take place on some global crypto-trading platforms. For instance, African users accounted for $7 billion of the $8.3 billion in Luno’s total trading volume. Binance P2P users in Africa also grew 2,000% within the past five months while their volumes increased by over 380%.

Individuals and small businesses across Nigeria, South Africa and Kenya account for most of the crypto activity on the continent. Chipper Cash is active in these countries and tapping into this opportunity is basically a no brainer. “Our approach to growing products and adding products is based on what our users find valuable. As you can imagine, crypto is one technology that has been widely adopted in Africa and many emerging markets. So we want to give them the power to access crypto and to be able to buy, hold, and sell crypto whenever,” the CEO added.

However, its crypto service isn’t available in Nigeria, the largest crypto market in Africa. The reason behind this is the Central Bank of Nigeria’s (CBN) regulation on crypto activities in the country prohibiting users from converting fiat into crypto from their bank accounts. To survive, most crypto players have adopted P2P methods but Chipper Cash isn’t offering that yet and according to Serunjogi, the company is “looking forward to any development in Nigeria that allows it to be offered freely again.”

The same goes for the investment service Chipper Cash plans to roll out in Nigeria and Uganda soon. Presently, Nigeria’s capital market regulator SEC is keeping tabs on local investment platforms and bringing their activities under its purview. Chipper Cash will not be exempt when the product is live in Nigeria and has begun engaging regulators to be ahead of the curve.

“As fintech explodes and as innovation continues to move forward, consumers have to be protected. We invest millions of dollars every year in our compliance programs, so I think working closely with the regulators directly so that these products are offered in a compliant manner is important,” Serunjogi noted.

Six billion-dollar companies in Africa; the fifth fintech unicorn

During our call, Serunjogi made some remarks about Nigeria’s central bank which resembles comments made by Flutterwave CEO Olugbenga Agboola back in March.

While acknowledging the central banks in Kenya, Rwanda, Uganda for creating environments where innovation can thrive, he said: “Nigeria has probably the most exciting and vibrant tech ecosystem in Africa. And that’s credit directly to CBN for creating and fostering an environment that allowed multiple startups like ourselves and others like Flutterwave to blossom.”

Most fintechs would argue that the CBN stifles innovation but comments from both CEOs seems to suggest otherwise. From all indication, Chipper Cash and Flutterwave strive to be on the right side of the country’s apex bank policies and regulations. It is why they are one of the fastest-growing fintechs in the region and also billion-dollar companies.

“Obviously, we’re not getting into our valuation, but we’re probably the most valuable private startup in Africa today after this round. So that’s a reflection of the environment that regulators like CBN have created to allowed innovation and growth, ” Serunjogi commented when asked about the company’s valuation.

Up until last week, the only private unicorn startup in Africa this year was Flutterwave. Then China-backed and African-focused fintech OPay came along as the company was reported to be in the process of raising $400 million at a $1.5 billion valuation. If Serunjogi’s comment is anything to go by, Chipper Cash is currently valued between $1-2 billion thus joining the exclusive billion-dollar club.

But to be sure, I asked Serunjogi again if the company is indeed a unicorn. This time, he gave a more cryptic answer. “We’re not commenting on the size of our valuation publicly. One of the things that I’ve been quite keen on internally and externally is that the valuation of our company has not been a focus for us. It’s not a goal we’re aspiring to achieve. For us, the thing that drives us is that we have a product that is impactful to our users.”

Maijid Moujaled (CTO) and Ham Serunjogi (CEO)

Serunjogi added that this investment actualizes the importance of possessing a solid balance sheet and onboarding SVB Capital and getting existing investors to double down is a means to that end. According to him, a strong balance sheet will provide the infrastructure needed to support key long-term investments which will translate to more exciting products down the road.

“We look at our investors as key partners to the business. So having very strong partners around the table makes us a stronger company. These are partners who can put capital into our business, and we’re also able to learn from them in several other ways,” he said of the investors backing the three-year-old company.

Just like Ribbit Capital and Bezos Expeditions in last year’s Series B, this is SVB Capital’s first foray into the African market. In an email, the managing director of SVB Capital Tilli Bannett, confirmed the fund’s investment in Chipper Cash. According to him, the VC firm invested in Chipper Cash because it has created an easy and accessible way for people living in Africa to fulfil their financial needs through enhanced products and user experiences.

“As a result, Chipper has had a phenomenal trajectory of consumer adoption and volume through the product. We are excited at the role Chipper has forged for itself in fostering financial inclusion across Africa and the vast potential that still lies ahead,” he added.

Fintech remains the bright spot in African tech investment. In 2020, the sector accounted for more than 25% of the almost $1.5 billion raised by African startups. This figure will likely increase this year as four startups have raised $100 million rounds already: TymeBank in February, Flutterwave in March, OPay and Chipper Cash this May. All except TymeBank are now valued at over $1 billion, and it becomes the first time Africa has seen two or more billion-dollar companies in a year. In addition to Jumia (e-commerce), Interswitch (fintech), and Fawry (fintech), the continent now has six billion-dollar tech companies.

Here’s another interesting piece of information. The timeframe at which startups are reaching this landmark seems to be shortening. While it took Interswitch and Fawry seventeen and thirteen years respectively, it took Flutterwave five years; Jumia, four years; then OPay and Chipper Cash three years.

from TechCrunch https://ift.tt/3yRTkd5

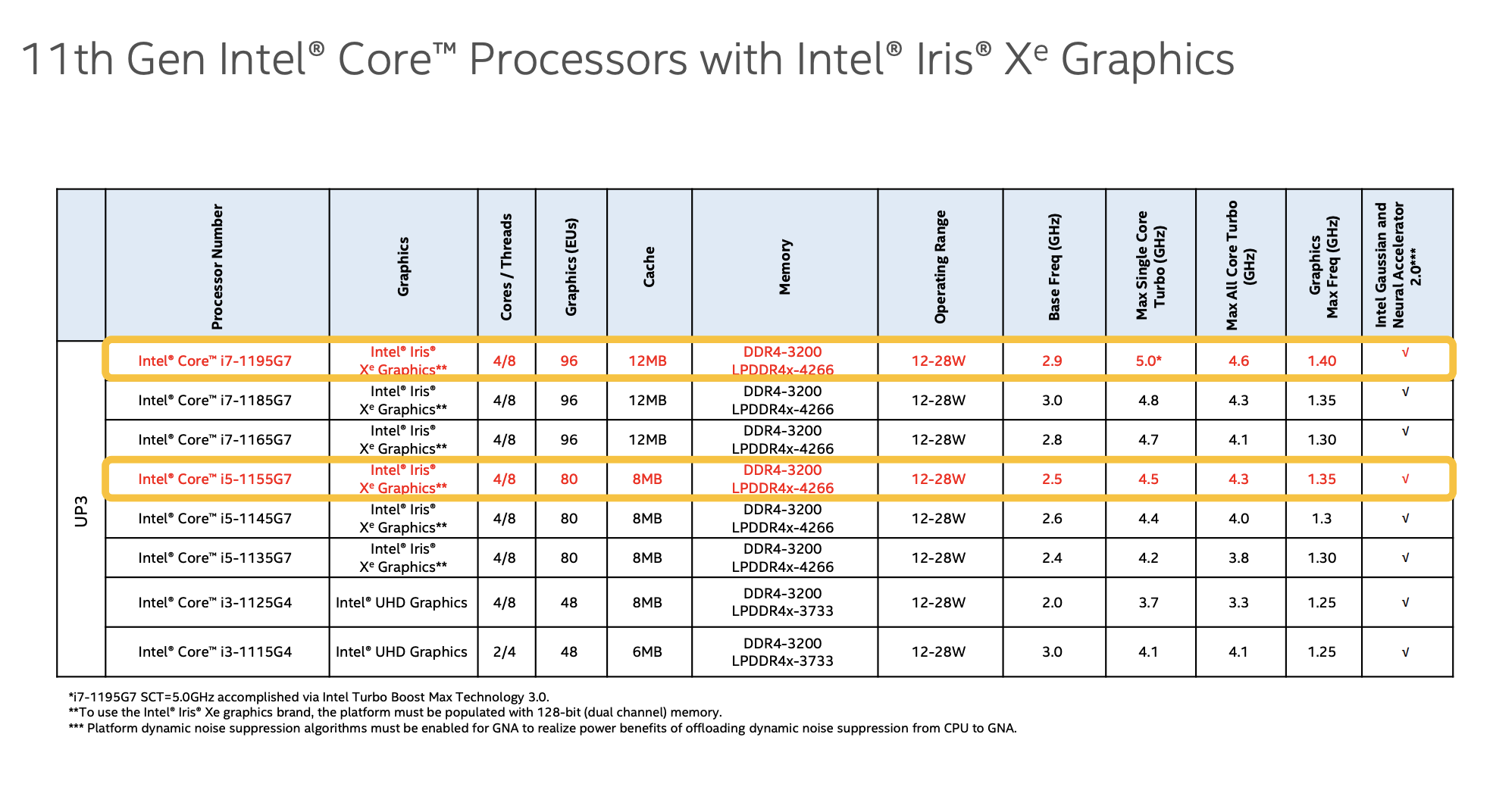

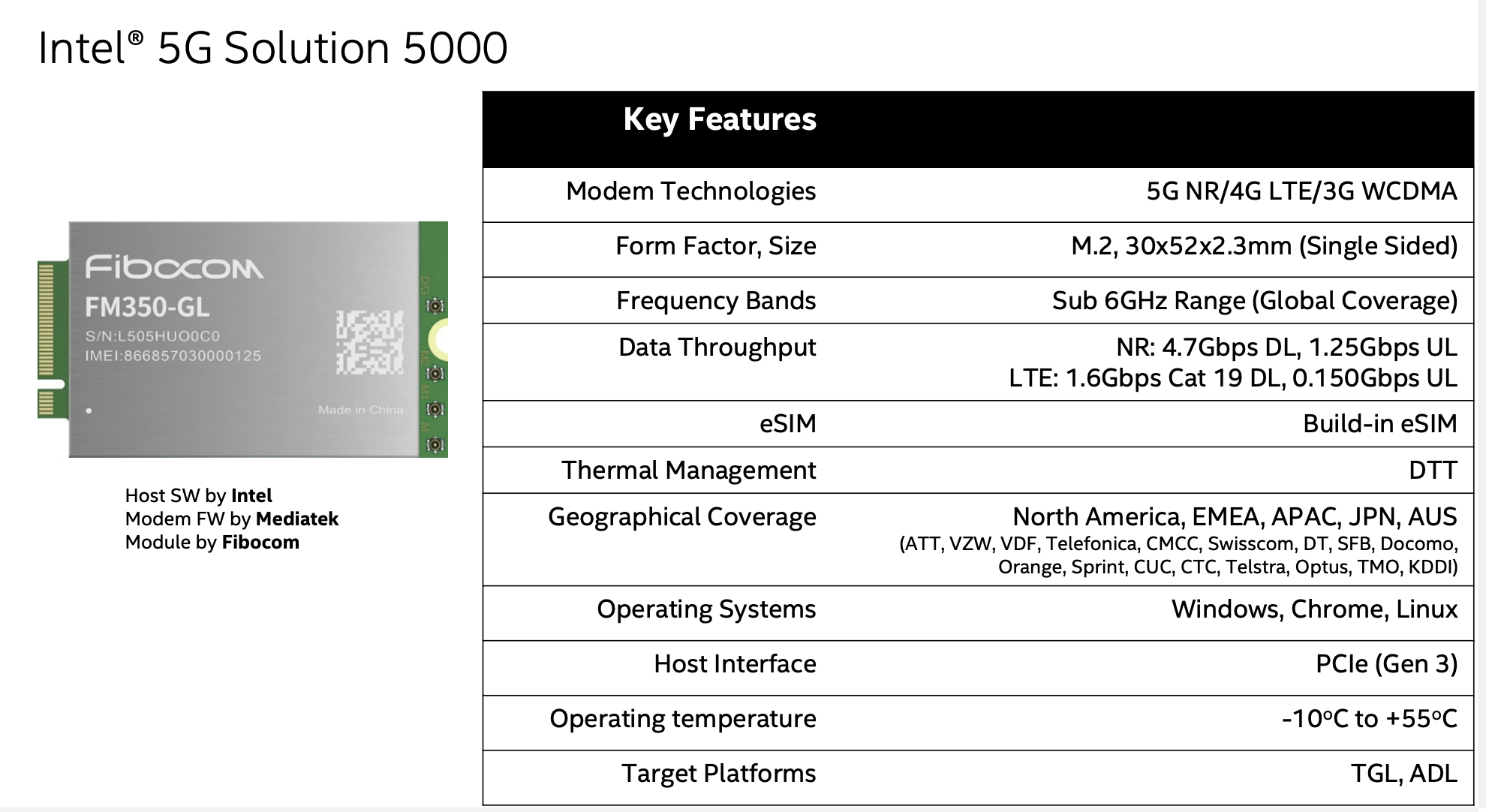

Intel announces two new 11th-gen chips and a 5G M.2 laptop module at Computex

Intel kicked off this year’s virtual Computex by announcing two new 11th Gen U-Series chips for use in thin, lightweight laptops. It also unveiled its first 5G M.2 module for laptops, designed in a partnership with MediaTek (Intel sold its smartphone modem business to Apple in 2019).

Both of Intel’s new chips have Intel Irix Xe graphics. The flagship model is the Core i7-1195G7, which has base clock speed is 2.9 GHz, but can reach up to 5.0 GHz on a single core using Intel’s Turbo Boost Max 3.0 tech. The other chip, called the Core i5-1155G7, has a base clock speed of 2.5GHzm and a maximum of 4.5GHz. Both chips have four cores and eight threads.

The 5G M.2 module, called the “5G Solution 5000,” supports 5G NR midband, sub-6GHz frequencies and eSIM tech. Intel has partnerships with telecoms in North America, EMEA, APAC, Japan and Australia. The module is expected to be in laptops produced by Acer, ASUS, HP and other manufacturers by the end of this year, and OEMs are also working on 250 designs based on 11th Gen U-Series chips, expected to hit the market by the holidays.

from TechCrunch https://ift.tt/34KVTjn